[ WIP ] Blockchain Basics: A Guide to Ethereum and Beyond

Welcome to "Blockchain Basics: A Guide to Ethereum and Beyond." In this book, we embark on a journey to unravel the intricacies of blockchain technology, focusing particularly on Ethereum and its transformative impact on decentralized applications (DApps), smart contracts, and the broader blockchain ecosystem.

medium

medium

1. The Evolution of Blockchain Technology

Blockchain technology has evolved rapidly since the inception of Bitcoin in 2009. What began as a peer-to-peer electronic cash system has blossomed into a diverse ecosystem of decentralized networks, each with its unique features and capabilities. Ethereum, launched in 2015, introduced the concept of programmable smart contracts, revolutionizing the way we think about blockchain applications and paving the way for a new era of decentralized innovation.

2. Understanding Ethereum and its Significance

Ethereum represents a quantum leap in blockchain technology, offering developers a flexible and powerful platform for building decentralized applications and executing smart contracts. At its core, Ethereum enables trustless transactions, transparent agreements, and censorship-resistant applications, democratizing access to financial services, governance mechanisms, and digital assets.

3. Navigating the Chapters Ahead

In this book, we delve into the fundamental concepts, tools, and applications of Ethereum, providing readers with a comprehensive understanding of blockchain technology and its real-world implications. From setting up an Ethereum wallet and acquiring Ether to exploring Ethereum development and interacting with decentralized applications, each chapter offers valuable insights and practical guidance for both beginners and experienced enthusiasts alike.

4. Embracing the Decentralized Future

As we navigate through the pages of "Blockchain Basics: A Guide to Ethereum and Beyond," we invite you to embrace the decentralized future and envision the endless possibilities of blockchain technology. Whether you're a developer seeking to build the next groundbreaking DApp or an enthusiast curious about the transformative potential of decentralized systems, this book serves as your roadmap to unlocking the full potential of Ethereum and beyond.

5. Let the Journey Begin

Join us as we embark on this journey into the heart of blockchain technology, where innovation knows no bounds, and the future is decentralized. Together, let's explore the limitless possibilities of Ethereum and pave the way for a more transparent, secure, and inclusive digital world.

Welcome to "Blockchain Basics: A Guide to Ethereum and Beyond." Let the journey begin!

About Author

I will not call my self the Author. Instead, I am editor of this book. The content is generated using Generative AI. I just tried to edit the content and make is useful to other. Generative AI, This cutting-edge technology has allowed me to delve into various fields of study to expand my knowledge and also offer valuable insights to readers.

My primary goal is to help others learn and spread knowledge. I believe that by sharing my insights, I can inspire others to take an interest in these topics and broaden their understanding. The topics I have covered range from technology to business to current events and more.

If you are interested in reading these books, I invite you to check them out and provide me with feedback or recommendations. Your insights will help me improve my writing and inspire me to continue sharing my knowledge with others.

About Editor

In this book, you'll be guided by an experienced Lead Software Engineer at JPMorgan Chase, with over 12 years of expertise in software development and a passion for blockchain technology. I specialize in smart contract development on platforms like Ethereum and Quorum, private blockchain networks, cloud migration to AWS, and frontend technologies like React. Join me as we explore the transformative potential of blockchain together.

1. Introduction to Blockchain Technology

Introduction to Blockchain Technology

In recent years, blockchain technology has emerged as a revolutionary force, transforming various industries and challenging traditional systems of governance, finance, and data management. At the forefront of this technological revolution stands Ethereum, a decentralized platform that has redefined the possibilities of blockchain beyond simple transactions. In this introductory chapter, we delve into the foundational concepts of blockchain technology and provide an overview of Ethereum's role in shaping the future of decentralized applications and smart contracts.

Understanding Blockchain Technology

Blockchain technology can be thought of as a distributed ledger system that enables secure and transparent record-keeping without the need for a central authority. At its core, a blockchain consists of a series of interconnected blocks, each containing a list of transactions. These blocks are cryptographically linked together, forming an immutable chain where data cannot be altered retroactively. This feature ensures the integrity and trustworthiness of the information stored on the blockchain.

Decentralization and Consensus Mechanisms

One of the key innovations of blockchain technology is its decentralized nature. Traditional systems rely on centralized authorities to validate and authenticate transactions, which can be prone to censorship, manipulation, and single points of failure. In contrast, blockchain networks operate on a peer-to-peer basis, where nodes collaborate to reach consensus on the validity of transactions. This consensus mechanism eliminates the need for intermediaries and fosters trust among network participants.

Introduction to Ethereum

While Bitcoin paved the way for blockchain technology, Ethereum introduced a new paradigm with its ability to execute programmable smart contracts. Founded by Vitalik Buterin in 2015, Ethereum is an open-source platform that enables developers to build decentralized applications (DApps) and deploy smart contracts on its blockchain. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum's versatility extends to a wide range of use cases, including finance, supply chain management, decentralized finance (DeFi), gaming, and more.

Smart Contracts and Decentralized Applications (DApps)

At the heart of Ethereum's innovation are smart contracts, self-executing contracts with the terms of the agreement directly written into code. Smart contracts enable automated and trustless interactions between parties, eliminating the need for intermediaries and reducing the risk of fraud or manipulation. Leveraging smart contracts, developers can create decentralized applications (DApps) that operate autonomously and transparently on the Ethereum blockchain. These DApps are transforming various industries by offering new models of governance, finance, and digital ownership.

The Promise of Ethereum

As we embark on this journey into the world of Ethereum and blockchain technology, it's essential to recognize the transformative potential of this groundbreaking innovation. From revolutionizing finance with decentralized lending protocols to enabling self-sovereign identity solutions and beyond, Ethereum represents a paradigm shift in how we perceive and interact with digital assets and decentralized systems. In the chapters that follow, we will explore the key concepts, tools, and applications of Ethereum, empowering you to embark on your own journey of discovery in this exciting and rapidly evolving field.

Definition of Blockchain

In the dynamic world of technology, where innovation is constant and disruption is the norm, few advancements have captured the collective imagination quite like blockchain. This introductory chapter serves as a foundational exploration into the very essence of blockchain technology, unraveling its intricacies and unveiling its transformative potential within the context of Ethereum and beyond.

Understanding Blockchain

At its core, blockchain can be best understood as a distributed ledger system that fundamentally alters the way data is recorded, stored, and verified. Unlike traditional centralized databases, where information is housed and managed by a single authority, blockchain operates across a decentralized network of computers (nodes), each holding a complete copy of the ledger. This decentralized architecture ensures that no single entity has control over the entire system, mitigating the risks associated with centralized points of failure and manipulation.

Key Characteristics of Blockchain

The hallmark features of blockchain technology set it apart from conventional data management systems:

- Decentralization: By distributing control and decision-making authority among a network of nodes, blockchain eliminates the need for intermediaries and central authorities, fostering a more inclusive and resilient ecosystem.

- Transparency: Every transaction recorded on the blockchain is visible to all participants in the network, ensuring a high degree of transparency and accountability. This transparency not only enhances trust among participants but also enables auditors and regulators to verify the integrity of transactions.

- Immutability: Once a transaction is confirmed and added to the blockchain, it becomes virtually immutable, meaning that it cannot be altered or deleted without broad consensus from the network. This immutability ensures the integrity and permanence of the data stored on the blockchain, making it tamper-resistant and highly secure.

- Consensus Mechanisms: Blockchain networks employ consensus mechanisms to validate and agree upon the state of the ledger. These mechanisms, such as Proof of Work (PoW), Proof of Stake (PoS), and others, ensure that all nodes in the network reach a consensus on the validity of transactions, maintaining the integrity of the blockchain.

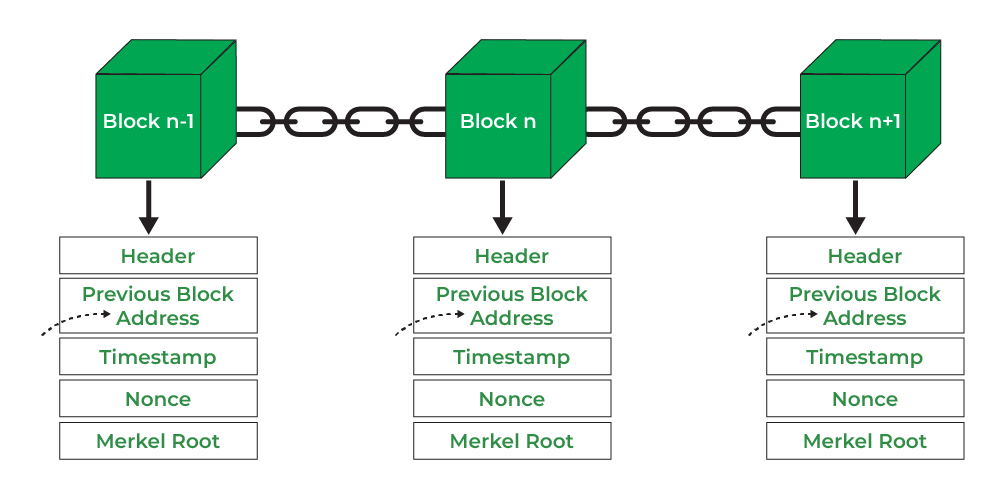

The Anatomy of a Blockchain

A blockchain is composed of a series of interconnected blocks, each containing a bundle of transactions and a reference to the previous block, forming a chronological chain of blocks. Each block is cryptographically hashed, creating a unique fingerprint that links it to the preceding block, thereby ensuring the continuity and integrity of the blockchain.

GeeksforGeeks

GeeksforGeeks

Applications of Blockchain Technology

While blockchain technology initially gained prominence as the underlying technology powering cryptocurrencies like Bitcoin, its applications extend far beyond digital currencies. Industries across sectors such as finance, supply chain management, healthcare, real estate, and beyond are exploring innovative ways to leverage blockchain to streamline processes, enhance transparency, and unlock new opportunities for collaboration and innovation.

Overview of Decentralized Systems

In the digital age, decentralized systems have emerged as a paradigm shift in how we conceive, build, and interact with technology. This chapter serves as a comprehensive exploration of decentralized systems, elucidating their fundamental principles, advantages, and implications within the context of blockchain technology, particularly Ethereum.

Understanding Decentralized Systems

Decentralized systems represent a departure from traditional centralized models, where authority, control, and decision-making are concentrated within a single entity or institution. In contrast, decentralized systems distribute power, governance, and data across a network of nodes, fostering greater resilience, transparency, and inclusivity. This distributed architecture enables peer-to-peer interactions, eliminates single points of failure, and enhances security and trust.

Key Characteristics of Decentralized Systems

Several key characteristics distinguish decentralized systems from their centralized counterparts:

- Distributed Governance: Decentralized systems rely on distributed governance mechanisms, where decision-making authority is dispersed among network participants through consensus algorithms. This democratic approach ensures that no single entity has undue influence over the system, promoting fairness and inclusivity.

- Resilience: Decentralized systems are inherently resilient to failures and attacks, as they lack centralized points of control that can be targeted by malicious actors. By distributing data and processing across multiple nodes, decentralized systems can withstand disruptions and maintain continuity even in adverse conditions.

- Transparency: Decentralized systems prioritize transparency by making data and processes visible to all participants in the network. This transparency fosters trust among users, as they can independently verify the integrity and authenticity of transactions and interactions.

- Scalability: Decentralized systems are designed to scale horizontally, meaning that additional nodes can be added to the network to accommodate increased demand without sacrificing performance or efficiency. This scalability enables decentralized systems to support growing user bases and evolving use cases.

Decentralized Systems in Practice

Decentralized systems find applications across a wide range of domains, including finance, governance, supply chain management, healthcare, and more:

- Decentralized Finance (DeFi): DeFi platforms leverage decentralized systems to enable peer-to-peer lending, borrowing, trading, and other financial services without the need for traditional intermediaries such as banks or brokers.

- Decentralized Autonomous Organizations (DAOs): DAOs are organizations governed by smart contracts and decentralized decision-making processes. These entities operate transparently and autonomously, enabling stakeholders to participate in governance and resource allocation.

- Decentralized Identity: Decentralized identity solutions leverage blockchain technology to provide individuals with greater control over their personal data and digital identities, reducing reliance on centralized authorities for identity verification.

Challenges and Considerations

While decentralized systems offer numerous benefits, they also present challenges and considerations that must be addressed:

- Scalability: Achieving scalability while maintaining decentralization and security remains a significant challenge for decentralized systems, particularly as user bases and transaction volumes continue to grow.

- Interoperability: Ensuring interoperability between different decentralized systems and protocols is essential for fostering collaboration and expanding the reach and utility of decentralized technologies.

- Regulatory Compliance: Navigating regulatory frameworks and ensuring compliance with relevant laws and regulations pose challenges for decentralized systems, particularly in sectors such as finance and healthcare.

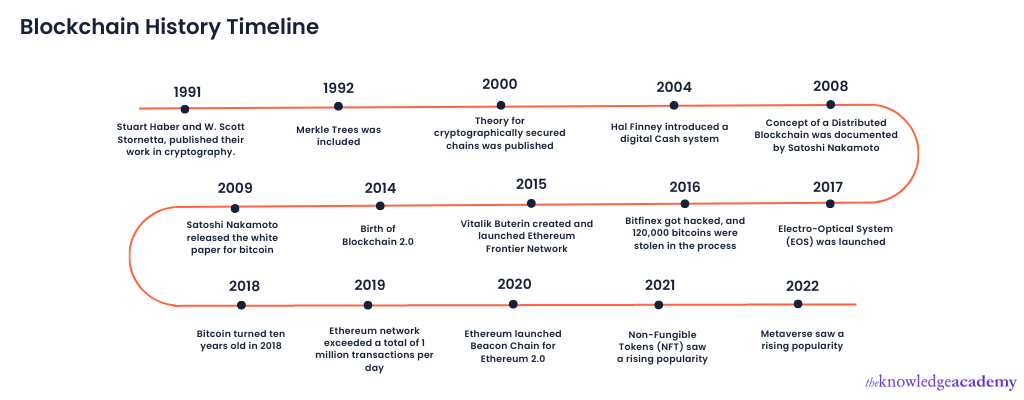

Brief History of Blockchain Technology

The evolution of blockchain technology is a captivating narrative that traces its roots back to the early days of digital currencies and cryptography. This chapter delves into the fascinating history of blockchain, highlighting key milestones, pivotal moments, and the visionary individuals who paved the way for its emergence as a revolutionary force in the world of technology and finance.

Genesis of Cryptography and Digital Currency

The story of blockchain technology begins with the advent of cryptography and the quest for secure digital communication. In the 1970s and 1980s, pioneers such as Whitfield Diffie, Martin Hellman, and Ralph Merkle laid the theoretical groundwork for public-key cryptography, which forms the basis of modern cryptographic systems.

In the early 1990s, cryptographers like David Chaum introduced the concept of digital cash, aiming to enable secure and anonymous transactions over the internet. Chaum's pioneering work laid the foundation for digital currency systems, inspiring subsequent innovations in the field.

theknowledgeacademy

theknowledgeacademy

Birth of Bitcoin

The pivotal moment in the history of blockchain technology came in 2008 with the publication of the Bitcoin whitepaper by an anonymous individual or group operating under the pseudonym Satoshi Nakamoto. The whitepaper, titled "Bitcoin: A Peer-to-Peer Electronic Cash System," outlined a decentralized digital currency system based on a novel data structure known as the blockchain.

In January 2009, the first Bitcoin block, known as the Genesis Block, was mined, marking the official launch of the Bitcoin network. Satoshi Nakamoto's creation introduced the world to the concept of blockchain—a distributed ledger that records all transactions in a transparent, immutable, and decentralized manner.

Rise of Alternative Blockchains

Following the success of Bitcoin, developers and entrepreneurs began exploring alternative blockchain implementations with varying features and capabilities. In 2013, Vitalik Buterin proposed Ethereum—a decentralized platform that extends the capabilities of blockchain beyond simple transactions to support smart contracts and decentralized applications (DApps).

Ethereum's launch in 2015 heralded a new era of blockchain innovation, empowering developers to build complex decentralized applications and programmable contracts on its platform. The introduction of Ethereum's native cryptocurrency, Ether (ETH), further fueled its adoption and cemented its position as a leading blockchain platform.

Expansion and Diversification

In the years that followed, blockchain technology continued to evolve and diversify, spawning a multitude of projects, platforms, and use cases across various industries. From decentralized finance (DeFi) and non-fungible tokens (NFTs) to supply chain management and identity verification, blockchain technology found applications in diverse domains, reshaping business models, and challenging traditional systems of governance and finance.

Challenges and Opportunities

Despite its promise and potential, blockchain technology faces numerous challenges, including scalability, interoperability, regulatory uncertainty, and environmental concerns associated with energy-intensive consensus mechanisms like Proof of Work (PoW). However, ongoing research and development efforts, coupled with growing institutional interest and investment, continue to drive innovation and propel blockchain technology forward.

2. Understanding Ethereum

The chapter "Understanding Ethereum" serves as a comprehensive introduction to the Ethereum blockchain platform, providing readers with a foundational understanding of its principles, architecture, and significance in the realm of decentralized systems. This chapter acts as a gateway for readers to explore Ethereum's capabilities, applications, and potential impact on various industries.

1. Introduction to Ethereum

The chapter begins by introducing Ethereum as a decentralized platform for executing smart contracts and building decentralized applications (DApps). It highlights Ethereum's origins, conceptualized by Vitalik Buterin and introduced to the world in 2015, and its evolution into a leading blockchain platform driving innovation and decentralization.

2. Core Concepts of Ethereum

Readers are introduced to key concepts that underpin Ethereum, such as:

- Decentralization: Ethereum's decentralized architecture and consensus mechanisms, which ensure resilience, security, and trustlessness.

- Smart Contracts: The concept of smart contracts, self-executing agreements written in code, and their role in automating processes and enabling trustless interactions.

- Ethereum Virtual Machine (EVM): The Ethereum Virtual Machine (EVM) as the runtime environment for executing smart contracts and DApps on the Ethereum blockchain.

- Ether (ETH): Ether (ETH) as the native cryptocurrency of the Ethereum network, used for transactions, smart contract execution, and network participation.

3. Features and Capabilities

The chapter explores Ethereum's features and capabilities, including:

- Smart Contract Functionality: How smart contracts enable complex logic and automation of agreements, leading to a wide range of applications in finance, supply chain, governance, and more.

- Decentralized Applications (DApps): An overview of decentralized applications built on Ethereum, showcasing their diversity and potential to disrupt traditional industries.

- Token Standards: Ethereum's support for token standards such as ERC-20 and ERC-721, which enable the creation of fungible and non-fungible tokens, respectively, and their role in tokenization and asset representation.

4. Ethereum Ecosystem and Use Cases

The chapter provides insights into the vibrant Ethereum ecosystem, highlighting:

- Decentralized Finance (DeFi): Ethereum's prominent role in powering the DeFi movement, facilitating lending, borrowing, trading, and yield farming.

- Non-Fungible Tokens (NFTs): The emergence of NFTs on Ethereum, revolutionizing digital ownership and unlocking new opportunities in art, gaming, and collectibles.

- Decentralized Autonomous Organizations (DAOs): The concept of DAOs, organizations governed by smart contracts and decentralized decision-making, and their potential to reshape governance and collaboration.

5. Challenges and Future Directions

Lastly, the chapter discusses challenges facing Ethereum, such as scalability, regulatory uncertainty, and competition, and explores future directions, including Ethereum 2.0 upgrades, Layer 2 solutions, and continued innovation in decentralized technologies.

By the end of the chapter, readers will have gained a solid understanding of Ethereum's fundamental concepts, features, and real-world applications, setting the stage for deeper exploration in subsequent chapters of the book.

Introduction to Ethereum

Ethereum, often hailed as the "world computer" of blockchain technology, has redefined the possibilities of decentralized applications and smart contracts since its inception. In this foundational chapter, we embark on a journey to understand the essence of Ethereum, its origins, core principles, and transformative potential in shaping the future of decentralized systems.

Origins of Ethereum

Ethereum emerged as the brainchild of Vitalik Buterin, a visionary young developer and writer, who proposed the concept in late 2013 and formalized it in the Ethereum whitepaper in 2014. Buterin's vision was to create a decentralized platform that goes beyond Bitcoin's singular focus on digital currency, empowering developers to build a wide range of decentralized applications (DApps) and programmable smart contracts on a single blockchain.

Core Principles of Ethereum

At its core, Ethereum embodies several key principles that differentiate it from other blockchain platforms:

-

Decentralization: Ethereum is designed to be decentralized, meaning that no single entity or authority has control over the network. Instead, Ethereum operates on a global network of nodes that collectively validate transactions and maintain the integrity of the blockchain.

-

Smart Contracts: Smart contracts are self-executing agreements with predefined terms written in code. Ethereum's support for smart contracts enables developers to create complex applications that can automate processes, facilitate transactions, and enforce agreements without the need for intermediaries.

-

Ethereum Virtual Machine (EVM): The Ethereum Virtual Machine (EVM) is a Turing-complete runtime environment that executes smart contracts on the Ethereum blockchain. It provides a sandboxed environment for executing code securely and deterministically across all nodes in the network.

-

Ether (ETH): Ether is the native cryptocurrency of the Ethereum network, serving as a means of exchange for transactions and smart contract execution fees. Ether also plays a crucial role in incentivizing network participants, securing the network through mining or staking, and governing protocol changes.

The Ethereum Ecosystem

Ethereum's vibrant ecosystem encompasses a diverse array of projects, platforms, and communities united by a shared vision of decentralized innovation. From decentralized finance (DeFi) protocols and non-fungible token (NFT) marketplaces to decentralized autonomous organizations (DAOs) and blockchain-based games, Ethereum offers a fertile ground for experimentation and collaboration.

Challenges and Opportunities

While Ethereum has achieved remarkable success and popularity, it also faces significant challenges and opportunities as it continues to evolve:

-

Scalability: Ethereum's scalability limitations, particularly high transaction fees and network congestion during periods of high demand, pose challenges for mainstream adoption and usability.

-

Security: Ensuring the security and robustness of smart contracts and decentralized applications remains a paramount concern, as vulnerabilities and exploits can lead to significant financial losses and reputational damage.

-

Ethereum 2.0: The transition to Ethereum 2.0, a major upgrade aimed at improving scalability, security, and sustainability through the introduction of a proof-of-stake consensus mechanism and shard chains, represents a critical milestone in Ethereum's evolution.

Conclusion

As we conclude our introduction to Ethereum, it becomes evident that Ethereum represents more than just a blockchain platform—it embodies a vision of decentralized innovation, empowerment, and collaboration. With its pioneering spirit, vibrant community, and relentless pursuit of progress, Ethereum continues to push the boundaries of what's possible in the realm of decentralized systems and applications. As we delve deeper into the world of Ethereum in the chapters that follow, we will explore its core concepts, applications, and implications, empowering readers to navigate and participate in this transformative ecosystem with confidence and clarity.

Chapter: How Ethereum Differs from Bitcoin

While Bitcoin and Ethereum are both prominent blockchain platforms, they serve distinct purposes and embody different philosophies. In this chapter, we explore the fundamental differences between Ethereum and Bitcoin, shedding light on their respective architectures, functionalities, and use cases.

1. Philosophical Foundations

Bitcoin, conceived by the pseudonymous Satoshi Nakamoto in 2008, was primarily designed as a decentralized digital currency aimed at enabling peer-to-peer transactions without the need for intermediaries. Its core philosophy revolves around censorship resistance, immutability, and scarcity, with a fixed supply cap of 21 million bitcoins.

Ethereum, on the other hand, was conceptualized by Vitalik Buterin in 2013 as a platform for decentralized applications (DApps) and smart contracts. While Ethereum shares some philosophical principles with Bitcoin, such as decentralization and trustlessness, its primary focus extends beyond digital currency to encompass programmable contracts and a broader spectrum of decentralized use cases.

2. Smart Contracts and Programmability

One of the most significant distinctions between Ethereum and Bitcoin lies in their approach to programmability. While Bitcoin offers a limited scripting language for creating simple transactions and multisignature wallets, Ethereum provides a Turing-complete scripting language that enables the creation of complex smart contracts.

Smart contracts are self-executing agreements with predefined conditions written in code. They enable developers to create decentralized applications (DApps) that can automate processes, facilitate transactions, and enforce agreements without the need for intermediaries. Ethereum's support for smart contracts makes it a versatile platform for a wide range of use cases beyond simple transactions.

3. Flexibility and Customization

Ethereum's flexible and extensible architecture allows developers to create custom tokens, decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), decentralized exchanges (DEXs), and more. Ethereum's ERC-20 standard, for example, has become the de facto standard for creating fungible tokens, while standards like ERC-721 have enabled the creation of unique, non-fungible assets.

Bitcoin, by contrast, has a more limited scripting language and is primarily focused on serving as a store of value and medium of exchange. While some projects have built layers and protocols on top of Bitcoin to extend its functionality, Ethereum's native support for smart contracts and DApps provides a more robust and flexible platform for innovation.

4. Consensus Mechanisms and Governance

Both Bitcoin and Ethereum rely on consensus mechanisms to validate transactions and secure the network, but they employ different approaches. Bitcoin currently operates on a proof-of-work (PoW) consensus mechanism, where miners compete to solve cryptographic puzzles and validate transactions in exchange for block rewards.

Ethereum is in the process of transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism as part of its Ethereum 2.0 upgrade. PoS consensus relies on validators staking their ether to secure the network and validate transactions, offering benefits such as reduced energy consumption and greater scalability.

Conclusion

In summary, while Bitcoin and Ethereum share some foundational principles, such as decentralization and trustlessness, they diverge significantly in their architectures, functionalities, and use cases. Bitcoin's focus on digital currency and store of value contrasts with Ethereum's broader vision of enabling decentralized applications and smart contracts. Understanding these differences is essential for navigating the diverse landscape of blockchain technology and unlocking its full potential for innovation and empowerment.

Chapter: Smart Contracts and Their Significance

Smart contracts represent a cornerstone of blockchain technology, empowering decentralized systems with automated, trustless, and transparent execution of agreements. In this chapter, we delve into the intricacies of smart contracts, exploring their definition, functionality, significance, and real-world applications within the Ethereum ecosystem.

1. Understanding Smart Contracts

A smart contract can be defined as a self-executing digital contract with predefined conditions written in code. These contracts operate on blockchain platforms like Ethereum, where they are stored, executed, and enforced by the network. Smart contracts eliminate the need for intermediaries by automating the execution of agreements, thereby reducing costs, minimizing the risk of fraud, and increasing efficiency.

2. Core Components of Smart Contracts

Smart contracts consist of several key components:

-

Code: The code of a smart contract defines its functionality and logic, specifying the conditions under which the contract will execute and the actions it will take based on inputs and triggers.

-

Data: Smart contracts can store and manipulate data, such as account balances, transaction history, and other relevant information needed to fulfill their intended purpose.

-

Execution Environment: Smart contracts execute within a secure and deterministic environment known as the Ethereum Virtual Machine (EVM). The EVM ensures that smart contracts behave predictably and consistently across all nodes in the network.

-

Digital Signatures: Smart contracts are cryptographically signed by the parties involved, ensuring that transactions are authenticated and tamper-proof. Once deployed, smart contracts cannot be altered or modified without the consensus of the network.

3. Significance of Smart Contracts

The significance of smart contracts lies in their ability to revolutionize the way agreements are made, executed, and enforced. Some key aspects of their significance include:

-

Trustless Execution: Smart contracts enable trustless transactions by automating the execution of agreements based on predefined conditions. This eliminates the need for trust in intermediaries or counterparties, as the contract's logic is enforced by the blockchain network.

-

Transparency and Immutability: Smart contracts are transparent, with their code and execution outcomes visible to all participants in the network. Once deployed, smart contracts are immutable and tamper-proof, ensuring that agreements are executed as intended and cannot be altered or manipulated.

-

Efficiency and Cost Savings: By automating processes and removing intermediaries, smart contracts streamline transactions, reduce administrative overhead, and lower costs. This efficiency makes smart contracts particularly well-suited for use cases such as supply chain management, financial transactions, and digital identity verification.

-

Complex Use Cases: Smart contracts enable the creation of complex decentralized applications (DApps) that can revolutionize industries such as finance, real estate, healthcare, and governance. These applications leverage smart contracts to automate processes, facilitate transactions, and enforce rules in a trustless and transparent manner.

4. Real-World Applications of Smart Contracts

Smart contracts find applications across a wide range of industries and use cases, including:

-

Decentralized Finance (DeFi): Smart contracts power decentralized finance platforms, enabling functions such as lending, borrowing, trading, and automated market making without the need for traditional intermediaries.

-

Supply Chain Management: Smart contracts facilitate transparent and efficient supply chain management by automating processes such as tracking, verification, and payment settlement.

-

Digital Identity: Smart contracts enable self-sovereign identity solutions, where individuals maintain control over their personal data and digital identities, reducing reliance on centralized authorities for identity verification.

-

Decentralized Autonomous Organizations (DAOs): Smart contracts govern the operation of decentralized autonomous organizations, enabling stakeholders to participate in governance, decision-making, and resource allocation in a transparent and democratic manner.

Conclusion

In conclusion, smart contracts represent a groundbreaking innovation in blockchain technology, offering a powerful tool for automating agreements, streamlining processes, and revolutionizing industries. Their significance lies in their ability to enable trustless transactions, enhance transparency, and unlock new possibilities for decentralized applications and systems. As we continue to explore the potential of smart contracts in the chapters that follow, we will discover their role in shaping the future of decentralized finance, governance, and digital interactions.

Ether (ETH) Cryptocurrency

Ether (ETH) is the native cryptocurrency of the Ethereum blockchain, serving as the fuel that powers transactions, smart contracts, and decentralized applications (DApps) within the Ethereum ecosystem. In this chapter, we delve into the intricacies of Ether, exploring its origins, functionalities, significance, and role in the broader landscape of decentralized finance and blockchain technology.

1. Origins of Ether

Ether was introduced as the native cryptocurrency of the Ethereum blockchain during its initial development phase in 2014. The Ethereum project, conceived by Vitalik Buterin and a team of developers, aimed to create a decentralized platform for executing smart contracts and building decentralized applications (DApps). Ether served as the primary means of incentivizing network participants, securing the network through mining, and facilitating transactions and smart contract executions.

2. Functionality and Utility

Ether serves several key functions within the Ethereum ecosystem:

-

Transaction Fees: Ether is used to pay for transaction fees incurred when sending Ether or interacting with smart contracts on the Ethereum blockchain. These fees, known as gas fees, compensate network participants, known as miners or validators, for validating and processing transactions.

-

Smart Contract Execution: Smart contracts deployed on the Ethereum blockchain require Ether to execute their functions and computations. Each operation performed by a smart contract, such as storing data or executing code, consumes a certain amount of gas, which is paid for in Ether.

-

Staking and Governance: With the transition to Ethereum 2.0, Ether holders have the opportunity to stake their Ether and become validators in the Ethereum network. Staking involves locking up a certain amount of Ether as a security deposit to help secure the network and validate transactions. In return, validators receive rewards in the form of additional Ether for their contributions to network security and consensus.

3. Significance of Ether

Ether plays a pivotal role in the Ethereum ecosystem and the broader landscape of blockchain technology:

-

Decentralized Finance (DeFi): Ether serves as the backbone of many decentralized finance (DeFi) applications, powering functions such as lending, borrowing, trading, and yield farming. Ether can be used as collateral to obtain loans, provide liquidity to decentralized exchanges, and participate in various DeFi protocols and yield farming strategies.

-

Digital Asset: Ether is a digital asset with intrinsic value, serving as a store of value and medium of exchange within the Ethereum ecosystem. Its scarcity, utility, and liquidity make it an attractive asset for investors, traders, and users seeking exposure to the Ethereum network and its decentralized applications.

-

Economic Incentive: Ether provides economic incentives for network participants, including miners, validators, developers, and users, to contribute to the security, growth, and sustainability of the Ethereum ecosystem. Incentives such as mining rewards, transaction fees, and staking rewards ensure the continued operation and evolution of the Ethereum network.

4. Challenges and Opportunities

While Ether has achieved significant success and adoption, it also faces challenges and opportunities as Ethereum continues to evolve:

-

Scalability: Ethereum's current proof-of-work (PoW) consensus mechanism faces scalability limitations, resulting in high transaction fees and network congestion during periods of high demand. The transition to Ethereum 2.0 and the adoption of a proof-of-stake (PoS) consensus mechanism aim to address these scalability challenges and improve network efficiency and throughput.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrencies like Ether remains uncertain and subject to change. Regulatory clarity and compliance are essential for ensuring the long-term viability and legitimacy of Ether and the Ethereum ecosystem.

-

Competition: Ether faces competition from other blockchain platforms and cryptocurrencies seeking to capture market share and drive innovation in decentralized finance, decentralized applications, and digital assets. Ethereum must continue to innovate and differentiate itself to maintain its leadership position in the industry.

Conclusion

In conclusion, Ether (ETH) stands as a cornerstone of the Ethereum ecosystem, playing a vital role in powering transactions, smart contracts, and decentralized applications. Its significance extends beyond its monetary value, serving as an economic incentive, governance mechanism, and digital asset with intrinsic utility and functionality. As Ethereum continues to evolve and adapt to meet the demands of a rapidly changing landscape, Ether remains at the forefront of innovation, empowerment, and decentralization in the world of blockchain technology.

3. Key Concepts of Ethereum

The chapter "Key Concepts of Ethereum" serves as a foundational exploration into the fundamental principles and components that underpin the Ethereum blockchain platform. In this chapter, readers will gain a comprehensive understanding of the essential concepts that define Ethereum's architecture, functionality, and significance in the realm of decentralized systems and applications.

1. Introduction to Ethereum

The chapter begins with an introduction to Ethereum, providing readers with context on its origins, goals, and evolution since its inception. Readers will learn about Ethereum's founder, Vitalik Buterin, and the vision behind creating a decentralized platform for executing smart contracts and building decentralized applications (DApps).

2. Decentralization and Consensus Mechanisms

Readers will delve into the concept of decentralization and its importance in the Ethereum ecosystem. The chapter explores how Ethereum achieves decentralization through its consensus mechanisms, such as proof-of-work (PoW) and the upcoming transition to proof-of-stake (PoS) in Ethereum 2.0. Readers will understand the role of miners and validators in securing the network and reaching consensus on transaction validity.

3. Smart Contracts and Ethereum Virtual Machine (EVM)

Smart contracts are central to Ethereum's functionality, enabling self-executing agreements written in code. Readers will explore the concept of smart contracts and their role in automating processes, enforcing agreements, and enabling decentralized applications. The chapter also introduces the Ethereum Virtual Machine (EVM) as the runtime environment for executing smart contracts on the Ethereum blockchain, ensuring consistency and security across all nodes.

4. Ether (ETH) Cryptocurrency

Ether (ETH) serves as the native cryptocurrency of the Ethereum network, powering transactions, smart contract executions, and network participation. Readers will learn about the functionalities of Ether, including its use in paying transaction fees (gas fees), staking for network security, and its significance as a digital asset within the Ethereum ecosystem. The chapter also explores the economic incentives provided by Ether to network participants, such as miners, validators, and developers.

5. Token Standards and Tokenization

Ethereum supports various token standards, such as ERC-20 and ERC-721, which enable the creation and management of fungible and non-fungible tokens (NFTs). Readers will gain insights into the significance of token standards in facilitating tokenization, representing digital assets, and enabling new forms of digital ownership and value exchange.

6. Decentralized Applications (DApps) and Use Cases

The chapter concludes with an exploration of decentralized applications (DApps) built on the Ethereum platform and their diverse use cases across industries such as finance, gaming, supply chain, and governance. Readers will understand how DApps leverage Ethereum's capabilities, including smart contracts and tokenization, to create innovative solutions that decentralize processes, enhance transparency, and empower users.

By the end of the chapter, readers will have acquired a solid understanding of the key concepts that define Ethereum's architecture, functionality, and ecosystem, laying the groundwork for further exploration into advanced topics and applications in subsequent chapters of the book.

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) lies at the core of the Ethereum blockchain, providing a decentralized execution environment for smart contracts. In this chapter, we will delve into the inner workings of the EVM, exploring its architecture, functionalities, and significance within the Ethereum ecosystem.

1. Understanding the Ethereum Virtual Machine

The Ethereum Virtual Machine (EVM) is a crucial component of the Ethereum blockchain, responsible for executing smart contracts in a decentralized and deterministic manner. Conceptually, the EVM can be thought of as a virtual computer that runs on every node in the Ethereum network, ensuring that smart contracts produce the same results across all nodes.

2. Architecture of the EVM

The EVM's architecture is stack-based, meaning it operates on a last-in, first-out (LIFO) data structure called the stack. Additionally, it includes components such as memory, storage, and a program counter (PC) to manage contract execution.

-

Stack: The stack is used to store operands and intermediate results during contract execution. Operations such as arithmetic, logical, and control flow instructions manipulate data stored in the stack.

-

Memory: The EVM provides a memory space for storing temporary data during contract execution. Memory is organized into a linear array of 32-byte words and is used for operations that require additional storage space.

-

Storage: Each Ethereum contract has its own persistent storage space, separate from memory and the stack. Storage is used for storing permanent state variables and data that persist across multiple contract invocations.

-

Program Counter (PC): The program counter tracks the current position in the bytecode instruction sequence, indicating the next instruction to be executed.

3. Execution of Smart Contracts

Smart contracts deployed on the Ethereum blockchain are written in high-level programming languages such as Solidity and compiled into bytecode instructions that are understood by the EVM. When a transaction invokes a smart contract, the EVM retrieves the contract's bytecode from storage, interprets the instructions, and executes the contract's logic according to predefined conditions.

During contract execution, the EVM processes transactions, updates contract state variables, and generates new transactions or events based on the contract's logic. Gas is used to pay for computational resources consumed during contract execution, preventing infinite loops or resource exhaustion attacks.

4. Security and Determinism

Security and determinism are paramount in the design of the EVM to ensure the integrity and reliability of smart contracts. Rigorous testing, auditing, and formal verification techniques are employed to identify and mitigate potential vulnerabilities in smart contracts and the EVM itself.

Determinism is achieved by strictly enforcing the order of execution and the behavior of operations, ensuring that contract execution produces the same results regardless of the node executing the transaction. This consistency is crucial for maintaining the trustworthiness of smart contracts and the Ethereum network as a whole.

5. Diagram of the Ethereum Virtual Machine (EVM)

ethereum.org

This diagram illustrates the architecture of the Ethereum Virtual Machine (EVM), including its components such as the stack, memory, storage, and program counter. It provides a visual representation of how smart contracts are executed within the EVM environment, highlighting the flow of data and instructions during contract execution.

Conclusion

The Ethereum Virtual Machine (EVM) serves as the backbone of the Ethereum blockchain, enabling the execution of smart contracts in a decentralized, secure, and deterministic manner. By understanding the architecture and functionalities of the EVM, developers and users can harness the power of smart contracts to build innovative decentralized applications and systems that redefine trust, transparency, and autonomy in the digital age.

Gas and Transaction Fees

In the Ethereum blockchain, every operation consumes computational resources, and to prevent abuse and ensure network efficiency, users must pay for these resources using a unit called gas. Gas is a fundamental concept in Ethereum's transaction processing mechanism and plays a crucial role in maintaining the network's security and integrity. In this chapter, we will explore the intricacies of gas, transaction fees, and their significance within the Ethereum ecosystem.

1. Understanding Gas

Gas is a unit of measure representing the computational effort required to execute operations or run programs on the Ethereum blockchain. Each operation in a smart contract consumes a specific amount of gas, depending on its complexity and resource requirements. Gas serves two primary purposes:

-

Resource Limitation: Gas limits the amount of computation that can be performed within a single transaction or smart contract execution. This prevents infinite loops, denial-of-service attacks, and other malicious activities that could degrade network performance or disrupt consensus.

-

Economic Incentive: Gas serves as an economic incentive for miners or validators to include transactions in blocks and execute smart contracts. Users must pay for gas using Ether (ETH), the native cryptocurrency of Ethereum, providing compensation to network participants for their computational resources and securing the network's integrity.

2. Gas Price and Gas Limit

Gas price refers to the amount of Ether (ETH) a user is willing to pay for each unit of gas consumed by a transaction. Gas price is denoted in Gwei, where 1 Gwei equals 0.000000001 ETH. Users can adjust the gas price to prioritize transaction inclusion and speed up confirmation times, especially during periods of network congestion.

Gas limit, on the other hand, represents the maximum amount of gas a user is willing to expend on a transaction or smart contract execution. It serves as a safety mechanism to prevent users from unintentionally spending too much Ether or running into out-of-gas errors. Transactions that exceed the gas limit are automatically reverted, and any unused gas is refunded to the sender.

3. Calculating Transaction Fees

Transaction fees are determined by multiplying the gas price by the gas consumed by a transaction. The formula for calculating transaction fees is as follows:

Transaction Fees = Gas Price (in Gwei) * Gas Used

Users must carefully consider the gas price and gas limit when submitting transactions to ensure they are cost-effective and executed efficiently. Higher gas prices can result in faster transaction confirmation times but may lead to increased fees, especially during periods of high network congestion.

4. Diagram: Gas and Transaction Fees

GeeksforGeeks

GeeksforGeeks

This diagram illustrates the relationship between gas, gas price, gas limit, and transaction fees in the Ethereum blockchain. It visualizes how users can adjust the gas price and gas limit to optimize transaction costs and ensure timely execution of transactions. Additionally, it highlights the role of miners or validators in processing transactions and earning fees for their computational efforts.

Conclusion

Gas and transaction fees are essential concepts in the Ethereum blockchain, governing the execution of smart contracts and the processing of transactions. By understanding how gas works and how transaction fees are calculated, users can make informed decisions when interacting with the Ethereum network, ensuring efficient and cost-effective transactions while supporting the network's security and integrity.

Nodes and Network Architecture

In the decentralized landscape of blockchain technology, nodes play a pivotal role in maintaining the integrity and functionality of the network. Understanding the architecture of nodes and their interactions within the network is essential for comprehending the decentralized nature of blockchain systems. In this chapter, we will delve into the intricacies of nodes and network architecture in the context of the Ethereum blockchain.

1. Nodes in the Ethereum Network

Nodes are individual computers or devices that participate in the Ethereum network by running Ethereum client software. Each node maintains a copy of the entire Ethereum blockchain, validates transactions, executes smart contracts, and communicates with other nodes to reach consensus on the state of the network. There are several types of nodes in the Ethereum network, including:

-

Full Nodes: Full nodes maintain a complete copy of the Ethereum blockchain and participate in the validation and propagation of transactions and blocks. They enforce all protocol rules and contribute to the decentralization and security of the network.

-

Light Nodes: Light nodes maintain a lightweight version of the Ethereum blockchain, relying on full nodes for transaction validation and block propagation. While light nodes consume fewer resources than full nodes, they sacrifice some degree of security and decentralization.

-

Miners: Miners are a special type of node that competes to solve cryptographic puzzles and add new blocks to the blockchain. They are responsible for processing transactions, executing smart contracts, and securing the network through proof-of-work (PoW) or, in the future, proof-of-stake (PoS) consensus mechanisms.

2. Network Architecture

The Ethereum network operates as a peer-to-peer (P2P) network, where nodes communicate directly with each other without the need for centralized intermediaries. The network architecture of Ethereum can be visualized as a decentralized mesh, where nodes form connections with multiple other nodes to propagate transactions and blocks across the network.

-

Peer Discovery: Nodes use peer-to-peer discovery protocols, such as Ethereum's Node Discovery Protocol (ENRP) or the Ethereum Wire Protocol (ETH), to discover and connect to other nodes in the network. Peers exchange information about the state of the blockchain, transaction pools, and network topology.

-

Data Propagation: When a node receives a new transaction or block, it validates the data and forwards it to its connected peers. Transactions and blocks propagate through the network in a peer-to-peer fashion until they are confirmed and included in the blockchain by miners.

3. Diagram: Nodes and Network Architecture

ethereum.org

ethereum.org

This diagram illustrates the network architecture of the Ethereum blockchain, depicting the interactions between different types of nodes and the propagation of data across the network. It visualizes how nodes form connections with each other, exchange information, and collaborate to maintain the integrity and functionality of the Ethereum network.

Conclusion

Nodes and network architecture are foundational components of the Ethereum blockchain, enabling decentralized consensus and peer-to-peer communication. By understanding the role of nodes and their interactions within the network, users can appreciate the decentralized nature of Ethereum and its resilience against censorship, manipulation, and single points of failure.

4. Getting Started with Ethereum

The chapter "Getting Started with Ethereum" serves as a comprehensive guide for beginners looking to explore the world of Ethereum and decentralized applications (DApps). In this chapter, readers will be introduced to the basic concepts, tools, and resources needed to embark on their journey into the Ethereum ecosystem.

1. Introduction to Ethereum

The chapter begins with an introduction to Ethereum, providing readers with an overview of its origins, goals, and significance in the realm of blockchain technology. Readers will learn about Ethereum's founder, Vitalik Buterin, and the vision behind creating a decentralized platform for executing smart contracts and building decentralized applications (DApps).

2. Setting Up an Ethereum Wallet

Readers will be guided through the process of setting up an Ethereum wallet, which serves as their gateway to the Ethereum blockchain. The chapter will cover various types of wallets, including software wallets, hardware wallets, and mobile wallets, and provide step-by-step instructions on how to create and secure a wallet.

3. Acquiring Ether (ETH)

Once readers have set up their Ethereum wallet, they will learn how to acquire Ether (ETH), the native cryptocurrency of the Ethereum network. The chapter will explore different methods for obtaining Ether, including purchasing it on cryptocurrency exchanges, earning it through mining or staking, or receiving it as payment for goods and services.

4. Interacting with DApps

With their Ethereum wallet funded with Ether, readers will be introduced to the concept of decentralized applications (DApps) and guided through the process of interacting with them. The chapter will showcase popular DApps in various categories, such as decentralized finance (DeFi), gaming, collectibles, and social networking, and provide instructions on how to access and use them.

5. Exploring Ethereum Development

For readers interested in exploring Ethereum development, the chapter will provide an overview of the tools, languages, and resources available for building smart contracts and decentralized applications. Readers will learn about programming languages such as Solidity and tools such as Truffle and Remix, as well as online resources, tutorials, and communities for Ethereum developers.

6. Staying Safe and Informed

Finally, the chapter will emphasize the importance of security and education in the Ethereum ecosystem. Readers will be provided with tips and best practices for securing their Ethereum wallet, avoiding scams and phishing attacks, and staying informed about the latest developments and updates in the Ethereum community.

By the end of the chapter, readers will have gained a solid foundation in Ethereum basics, acquired the necessary tools and resources to start exploring the Ethereum ecosystem, and be well-equipped to embark on their journey into the exciting world of decentralized finance, applications, and innovation.

Setting Up a WalletIntroduction

Setting up an Ethereum wallet is the first step towards engaging with the Ethereum blockchain and its ecosystem of decentralized applications (DApps) and digital assets. In this chapter, we will explore the process of setting up an Ethereum wallet, the different types of wallets available, and the importance of security in protecting your funds.

1. Understanding Ethereum Wallets

Ethereum wallets are software applications that allow users to securely store, send, and receive Ether (ETH) and other Ethereum-based tokens. There are several types of wallets, each offering different levels of security, accessibility, and functionality:

-

Software Wallets: These wallets are applications that run on desktop computers, mobile devices, or web browsers. They provide convenient access to your funds but may be susceptible to hacking or malware if not properly secured.

-

Hardware Wallets: Hardware wallets are physical devices that store your private keys offline, providing an extra layer of security against online threats. They are ideal for long-term storage of large amounts of Ether and are considered one of the most secure wallet options.

-

Paper Wallets: Paper wallets involve printing out your private key and public address on a physical piece of paper. While paper wallets offer excellent security as they are not susceptible to hacking, they require careful handling to prevent loss or damage.

anycoindirect

2. Steps to Setting Up a Wallet

The process of setting up an Ethereum wallet typically involves the following steps:

-

Choose a Wallet: Select a wallet that best fits your needs and preferences. Consider factors such as security, convenience, and platform compatibility when making your decision.

-

Download or Access the Wallet: Depending on the type of wallet chosen, download the software application, access the web-based platform, or connect the hardware device to your computer or mobile device.

-

Generate a New Wallet: Follow the instructions provided by the wallet provider to generate a new Ethereum wallet. This typically involves creating a strong password or PIN and securely storing your recovery phrase or seed phrase.

-

Backup Your Wallet: Backup your wallet's recovery phrase and store it in a safe and secure location. This recovery phrase is crucial for recovering access to your wallet in case your device is lost, stolen, or damaged.

-

Receive and Send Ether: Once your wallet is set up and secured, you can receive Ether by sharing your public address with others or sending Ether by entering the recipient's address and the amount you wish to send.

Conclusion

Setting up an Ethereum wallet is a crucial step towards engaging with the Ethereum blockchain and participating in its decentralized ecosystem. By following the steps outlined in this chapter and choosing a wallet that meets your security and usability requirements, you can safely store your Ether and interact with decentralized applications and digital assets on the Ethereum network.

Acquiring Ether (ETH)

Acquiring Ether (ETH), the native cryptocurrency of the Ethereum blockchain, is essential for participating in the Ethereum ecosystem, executing transactions, and interacting with decentralized applications (DApps). In this chapter, we will explore various methods for acquiring Ether, including purchasing it on cryptocurrency exchanges, earning it through mining or staking, and receiving it as payment.

1. Purchasing Ether on Cryptocurrency Exchanges

Cryptocurrency exchanges provide a convenient and accessible way to purchase Ether using fiat currency or other cryptocurrencies. The process typically involves the following steps:

-

Sign Up: Create an account on a reputable cryptocurrency exchange that supports Ether trading. Provide necessary identification and verification information as required by the exchange.

-

Deposit Funds: Deposit funds into your exchange account using fiat currency or other cryptocurrencies. Some exchanges may offer multiple payment methods, such as bank transfers, credit/debit cards, or online payment services.

-

Place an Order: Navigate to the Ether trading pair on the exchange and place a buy order specifying the amount of Ether you wish to purchase and the price you are willing to pay. Once your order is matched with a seller, the Ether will be credited to your exchange account.

-

Withdraw Ether: After purchasing Ether, you can withdraw it from the exchange to your personal Ethereum wallet for safe storage and control over your funds.

2. Earning Ether Through Mining

Mining is the process of validating transactions and adding new blocks to the Ethereum blockchain in exchange for rewards in the form of Ether. While Ethereum mining traditionally required specialized hardware and significant computational resources, the upcoming transition to Ethereum 2.0 will introduce proof-of-stake (PoS) consensus mechanism, allowing users to earn rewards by staking their Ether instead of mining.

-

Mining Equipment: To mine Ether using proof-of-work (PoW), miners require specialized hardware known as graphics processing units (GPUs) or application-specific integrated circuits (ASICs) to perform complex calculations and compete for block rewards.

-

Join a Mining Pool: Due to the increasing difficulty and competition in Ethereum mining, many miners choose to join mining pools, where they combine their computational power and share rewards proportionally based on their contributions.

-

Earn Rewards: Miners earn Ether rewards for successfully mining and validating new blocks, which are distributed among pool members based on their mining contributions. Rewards may vary depending on factors such as block difficulty, gas fees, and network congestion.

3. Staking Ether for Ethereum 2.0

With the transition to Ethereum 2.0, users will have the opportunity to stake their Ether and become validators in the Ethereum network. Staking involves locking up a certain amount of Ether as a security deposit to help secure the network and validate transactions.

-

Validator Requirements: To become a validator, users must meet certain requirements, including holding a minimum amount of Ether as a stake, running a validator node, and maintaining online presence and performance to participate in block validation and consensus.

-

Earn Staking Rewards: Validators earn rewards in the form of additional Ether for their contributions to network security and consensus. Staking rewards are distributed periodically based on validator performance and participation in block validation.

Conclusion

Acquiring Ether is a fundamental step for participating in the Ethereum ecosystem and accessing its decentralized applications and services. By understanding the different methods for acquiring Ether and their associated rewards and considerations, users can choose the approach that best fits their preferences, resources, and goals for engaging with the Ethereum blockchain.

Interacting with the Ethereum Network

Interacting with the Ethereum network involves engaging with various aspects of its decentralized ecosystem, from executing transactions and deploying smart contracts to interacting with decentralized applications (DApps). In this chapter, we will explore the process of interacting with the Ethereum network, including sending and receiving Ether, deploying smart contracts, and using decentralized applications.

1. Sending and Receiving Ether

Sending and receiving Ether (ETH) is one of the most common interactions with the Ethereum network. Whether you're transferring funds to friends, paying for goods and services, or contributing to crowdfunding campaigns, the process is straightforward:

-

Sending Ether: To send Ether, you need the recipient's Ethereum address. Simply initiate a transaction from your Ethereum wallet, specify the recipient's address, and enter the amount of Ether you wish to send. Confirm the transaction and wait for it to be processed and included in the blockchain.

-

Receiving Ether: Receiving Ether is even easier. Share your Ethereum address with the sender, either by providing them with your public address or scanning a QR code. Once the sender initiates the transaction, you will receive the specified amount of Ether in your wallet.

2. Deploying Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Deploying a smart contract on the Ethereum network allows you to automate processes, enforce agreements, and create decentralized applications. The process of deploying a smart contract involves:

-

Writing Smart Contract Code: Develop your smart contract code using programming languages such as Solidity, Vyper, or LLL. Define the contract's logic, functions, and data structures to meet your requirements.

-

Compiling and Deploying: Compile your smart contract code into bytecode using an Ethereum-compatible compiler. Deploy the bytecode to the Ethereum network by submitting a transaction that includes the contract's bytecode and deployment parameters.

-

Interacting with the Contract: Once deployed, your smart contract is assigned a unique address on the Ethereum blockchain. You can interact with the contract by calling its functions, sending transactions, and querying its state using your Ethereum wallet or through DApps.

3. Using Decentralized Applications (DApps)

Decentralized applications (DApps) are applications that run on the Ethereum blockchain, leveraging smart contracts to provide trustless and transparent functionality. Interacting with DApps allows users to access a wide range of services and functionalities, including:

-

Decentralized Finance (DeFi): Participate in lending, borrowing, trading, and yield farming protocols to manage your finances and earn returns on your assets.

-

Gaming and Collectibles: Play blockchain-based games, collect digital assets such as non-fungible tokens (NFTs), and participate in virtual economies.

-

Governance and DAOs: Engage in decentralized autonomous organizations (DAOs) and participate in community governance, decision-making, and voting processes.

4. Diagram: Interacting with the Ethereum Network

oreilly

oreilly

This diagram illustrates the process of interacting with the Ethereum network, including sending and receiving Ether, deploying smart contracts, and using decentralized applications (DApps). It visualizes the flow of transactions, smart contract deployment, and DApp interactions, highlighting the seamless integration of these components within the Ethereum ecosystem.

Conclusion

Interacting with the Ethereum network opens up a world of possibilities, from sending and receiving funds to deploying smart contracts and using decentralized applications. By understanding the process of interacting with the Ethereum network and the various tools and resources available, users can harness the full potential of blockchain technology and participate in the decentralized revolution.

Exploring Ethereum Development

Ethereum development offers exciting opportunities for building decentralized applications (DApps), smart contracts, and innovative solutions that leverage blockchain technology. In this chapter, we will explore the world of Ethereum development, including programming languages, development tools, and resources for getting started as an Ethereum developer.

1. Understanding Ethereum Development

Ethereum development involves building applications and smart contracts that run on the Ethereum blockchain. Unlike traditional software development, Ethereum development requires an understanding of blockchain principles, smart contract languages, and decentralized application architectures. Key concepts to grasp include:

-

Blockchain Fundamentals: Understanding the decentralized nature of blockchain networks, consensus mechanisms, transaction processing, and cryptographic principles is crucial for Ethereum development.

-

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Ethereum developers use languages like Solidity, Vyper, or LLL to write smart contracts that automate processes and enforce agreements on the Ethereum blockchain.

-

Decentralized Applications (DApps): DApps are applications that run on a decentralized network of computers, leveraging smart contracts for backend logic and providing a user interface through web or mobile interfaces. Ethereum developers build DApps to provide trustless and transparent functionality across various industries and use cases.

2. Tools and Resources for Ethereum Development

Ethereum developers have access to a wide range of tools, libraries, frameworks, and resources to streamline the development process and build robust and secure applications. Some essential tools and resources include:

-

Integrated Development Environments (IDEs): IDEs like Remix, Truffle, and Visual Studio Code offer developers a suite of tools for writing, compiling, debugging, and deploying smart contracts and DApps.

-

Ethereum Client Libraries: Libraries like Web3.js, ethers.js, and web3.py provide APIs for interacting with the Ethereum blockchain, allowing developers to send transactions, query contract state, and listen for events programmatically.

-

Testing Frameworks: Testing smart contracts is crucial for ensuring their functionality and security. Testing frameworks like Truffle, Hardhat, and Waffle allow developers to write and execute automated tests to verify the behavior of their smart contracts.

-

Community and Documentation: Ethereum's vibrant developer community provides a wealth of resources, including documentation, tutorials, forums, and developer communities like Ethereum Stack Exchange and Reddit's Ethereum subreddit. Engaging with the community and seeking help from experienced developers can accelerate the learning process and troubleshoot issues.

3. Getting Started with Ethereum Development

To get started with Ethereum development, developers can follow these steps:

-

Learn the Basics: Familiarize yourself with blockchain fundamentals, Ethereum concepts, and smart contract development principles through online courses, tutorials, and documentation.

-

Choose a Language and IDE: Select a programming language and development environment that best suits your preferences and requirements. Solidity is the most commonly used language for writing smart contracts, while Remix and Truffle are popular IDEs for Ethereum development.

-

Practice and Experiment: Start by building simple smart contracts and DApps to gain hands-on experience with Ethereum development. Experiment with different features, functionalities, and use cases to deepen your understanding and skills.

-

Join the Community: Engage with the Ethereum developer community through forums, social media, and developer meetups. Collaborate with other developers, seek feedback on your projects, and stay updated on the latest developments and best practices in Ethereum development.

Conclusion

Exploring Ethereum development opens up a world of opportunities for building decentralized applications, smart contracts, and blockchain-based solutions. By understanding the fundamentals of Ethereum development, choosing the right tools and resources, and actively engaging with the developer community, developers can unlock their creativity and contribute to the growth and innovation of the Ethereum ecosystem.

5. Smart Contracts

In Ethereum, smart contracts are self-executing contracts with predefined terms and conditions directly written into code. These contracts are deployed and executed on the Ethereum blockchain, enabling trustless and transparent agreements to be enforced without the need for intermediaries. Smart contracts are written in programming languages like Solidity and operate autonomously, executing predefined actions when triggered by specified conditions. They facilitate a wide range of functionalities, including financial transactions, asset transfers, digital identity verification, supply chain management, decentralized governance, and more. Smart contracts are a fundamental building block of decentralized applications (DApps) on the Ethereum platform, enabling developers to create innovative solutions that revolutionize industries and redefine traditional business processes.

More on smart contracts

-

Self-Executing Contracts: Smart contracts are digital agreements that are programmed to execute automatically when predefined conditions are met. Once deployed on the Ethereum blockchain, smart contracts operate autonomously, without the need for human intervention or intermediaries to enforce the terms of the agreement. This self-executing nature ensures that transactions and agreements are executed precisely as programmed, eliminating the potential for fraud or manipulation.

-

Code as Law: The phrase "code is law" encapsulates the idea that smart contracts operate based on the code written by developers. Once deployed, the code of a smart contract cannot be altered or tampered with, providing immutability and reliability to the parties involved in the agreement. This concept underscores the trustless nature of smart contracts, as participants can rely on the integrity of the code to enforce the terms of the agreement.

-

Programming Languages: Smart contracts on the Ethereum blockchain are typically written in languages like Solidity, Vyper, or LLL (Low-Level Lisp-like Language). These languages are specifically designed for writing smart contracts and allow developers to define the logic and behavior of the contract's functions, as well as handle data storage and manipulation.

-

Decentralized Applications (DApps): Smart contracts serve as the backbone of decentralized applications (DApps) on the Ethereum platform. DApps are applications that run on a decentralized network of computers (nodes) and leverage smart contracts to provide trustless and transparent functionality. Examples of DApps include decentralized finance (DeFi) platforms, non-fungible token (NFT) marketplaces, decentralized exchanges (DEXs), and more.

-

Use Cases: Smart contracts enable a wide range of use cases across various industries. In finance, they can be used for lending and borrowing, automated investment strategies, and insurance. In supply chain management, smart contracts can track the provenance of goods, ensure compliance with regulations, and automate payments. Smart contracts also find applications in digital identity verification, decentralized governance, voting systems, and more.

-

Execution and Gas Fees: Executing smart contracts on the Ethereum blockchain requires computational resources, which are paid for using a unit of measure called "gas." Gas fees are paid in Ether (ETH), the native cryptocurrency of the Ethereum network, and are used to compensate network validators for processing transactions and executing smart contracts. The complexity of a smart contract's code and the amount of computational resources required determine the gas fees associated with its execution.

In summary, smart contracts in Ethereum represent a powerful tool for automating agreements, transactions, and processes in a trustless and transparent manner. By leveraging smart contracts, developers can create innovative solutions that revolutionize industries, empower individuals, and reshape the future of decentralized finance and applications.

Writing and Deploying Smart Contracts

In this chapter, we'll dive into the fascinating world of writing and deploying smart contracts on the Ethereum blockchain. Smart contracts serve as the backbone of decentralized applications (DApps), enabling trustless and transparent execution of agreements and automated processes. We'll explore the process of writing smart contract code, testing it, and deploying it onto the Ethereum network, empowering readers to create their own decentralized solutions.

1. Understanding Smart Contract Development

Before diving into writing smart contracts, it's crucial to understand the fundamentals of smart contract development. This section will cover:

- What are smart contracts: Explanation of the concept and how they function.